Change Your Money Mindset When Creating a Budget

Featuring: Erin La Grassa

Interview & video by: Catie Menke

Copy by: Shannon Holt

Catie sat down with Erin La Grassa from Money Matters AZ, a bookkeeping and financial freedom business. Catie and Erin are discussing all things money. More specifically how to change your money mindset to successfully make and keep a budget.

La Grassa is taking a bit of a different approach. These tips from La Grassa aren’t going to talk about the percentages breakdown of your budget or even the best way to pay off debt. This is all about your mindset and the thought process of how you think about money.

Art Direction by: Catie Menke. Photograph by: Shannon Holt. Location: Scottsdale Fashion Square.

So what’s the first thing we need to change in regards to our mindset on setting a budget? According to La Grassa, we need to remember that “creating a budget is just a tool. It is not an end all be all.” When you set a budget you will be making changes. It will be something you need to look at on a regular basis and reevaluate. The best thing to do is to “look at where you are now and then where you want to be,” says La Grassa, “if you don’t know where you want to be, you’ll never get to where you are going.”

Art Direction: Catie Menke. Photograph by: Shannon Holt. Location: Scottsdale Fashion Park.

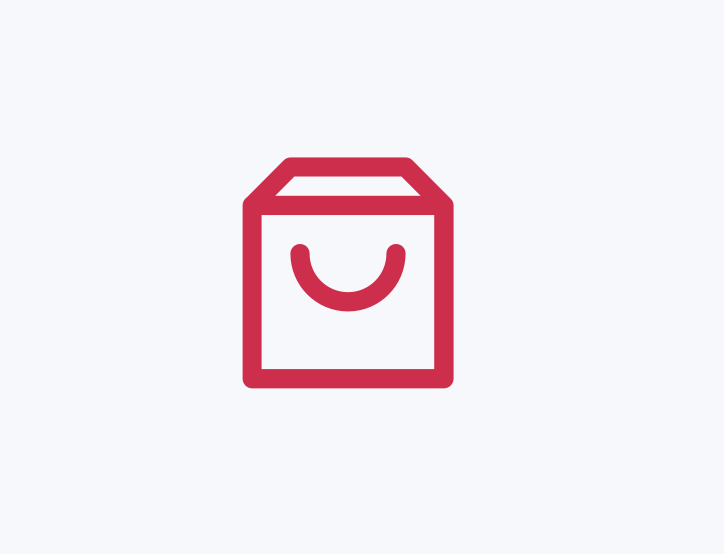

Write everything down

The act of writing things down helps us to better retain/understand what we are learning/doing. La Grassa recommends starting on a monthly basis and physically writing out any and all income you have. Then write out any and all expenses you have. Break it down and take the time to really understand what your budget can look like. Writing this all out will give you awareness and clarity which will help you make better and more informed decisions in regards to your spending habits.

Pay Yourself First

No, this doesn’t mean spending money to go buy new clothes or going out. When La Grassa says to pay yourself first, she is referring to your future self. “Put the money into savings, investments, or even a big trip you want to take,” she clarifies. Take the time to look at what you want your financial future to look like, how much money you want to have and start planning for that. La Grassa explains, “If you have more money, surround yourself with more money, and get comfortable with money, you’ll attract more money.” And you can do just that by paying your (future) self first.

Automate as much as possible

While you should always be paying attention to your accounts, La Grassa believes that having everything automated will help to keep you accountable. “If you say you want to save 3% of your income, automate it immediately and you will.” Bills, savings, donations, have it all set to be paid directly out of your bank account. It will make your life easier and prevent any fees accrued from paying something late.

Make donating a priority

Giving a percentage of your income to a charity or cause close to your heart will help to change your mindset on money. La Grassa believes that “as humans, we feel good when we give and we can benefit greatly from that” and that “if we think of money in a positive way, we can create abundance for ourselves and we can then ooze abundance for everyone around us.”

Giving to charity doesn’t have to be anything drastic. “Start small and work your way up to whatever is comfortable to you,” La Grassa recommends. Small changes can make a world of difference and working a donation into your budget not only benefits the cause of your choice but will help you to see money in a more positive light.

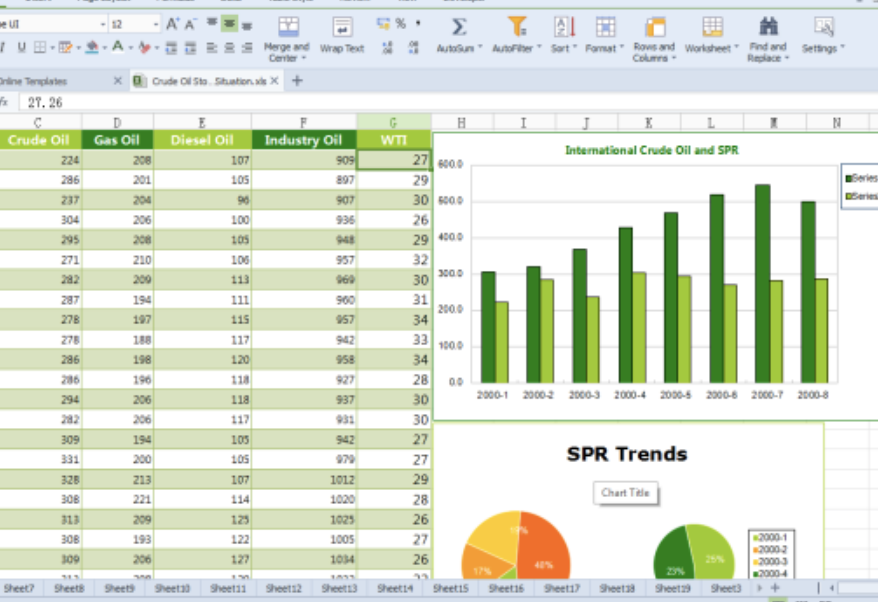

Accelerate debt, invest and save all at the same time

When you are taking the time to figure out your budget be sure to work out what percentages can go into paying off debt, investing and saving all at once. “Don’t dump all your money into paying off the debt and then not have anything left to invest or save,” La Grassa points out. While people have different views on this, La Grassa believes you are better off decreasing your debt while at the same time increasing your savings.

This idea goes back to looking towards the future. Paying off your debt is important, but according to La Grassa, “you lose out on a lot of money if you only focus on paying off the debt.” So while you work on paying off the debt, don’t forget about your financial future.